The Sports Data Value Chain: Towards a New Business Model For Sports Organisations

There is a curiosity and determination amongst professional and amateur football federations, associations and leagues around the globe to understand the on-field data ecosystem better and realise opportunities for value creation for its members and partners.

The ownership of sports data has evolved, driven by technological advancements and changing business models. Sports organisations themselves have been initially outside the sports data value chain (In relevance, read how leagues should be taking the lead) as the collection was done unofficially. The organisations themselves were yet to discover the sports data opportunity. The growth of sports data companies has gone hand-in-hand with the commercial growth of betting activities in the European markets. Only later, sports organisations entered into the value chain, but only as a paying client initially.

As sports organisations recognised the intrinsic value of sports data, a distinct contrast emerged in the maturity of data strategies across various sports. Traditionally, European football leagues were perceived as latecomers to the data-driven landscape, unlike major North American sports leagues such as the NFL, NBA, MLB, and NHL, pioneers in leveraging data for sports performance and fan engagement.

However, in recent years, national associations, federations, and football leagues worldwide have taken a more proactive stance, recognising the need to assert greater control and capitalise on the commercial and intellectual potential offered by data. Progressing at varying paces and adopting diverse business models, many of these sports organisations have developed centralised sports data strategies. In this article, our CBO, Leander Montbaliu, and CEO of Twenty3, Andrew Cox, delve deeper into the distinct categories of data, elucidate the significance of data for sports organisations, explore the diverse stages of attaining greater ownership, highlight compelling use cases, and offer our insights into the future of data in sports.

What Data Are We Talking About?

In the mid-twentieth century, Charles Reep collected numbers of shots and length of passing moves in football matches. In the late 1990s, detailed event data was developed by companies such as Opta and Prozone. In contrast, the fast collection and distribution of essential match events were optimised by RunningBall and Sportradar. In the 2010s, expected goals entered the mainstream. Each stage marked a moment in the evolution of football data.

It is essential to understand different types of match, team and player performance data based on standard, though not universal, industry definitions.

Beyond this relatively simple classification of football data, it should be acknowledged that there are infinite ways to define further the composition of data within these categories (i.e. latency and accuracy), as well as other specificity most often linked to the method of data collection (i.e. Optical tracking, GPS tracking, AI tracking).

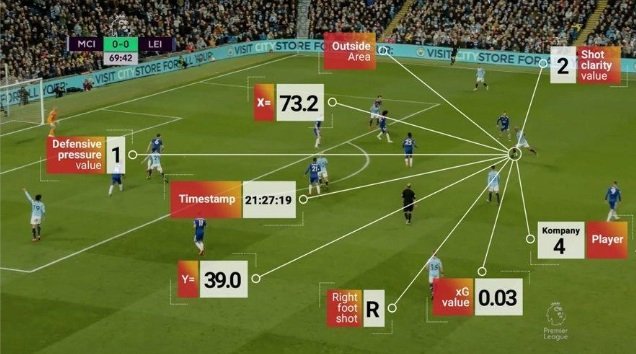

Illustration of Optical and GPS Tracking Technology

Notably, FIFA has recently developed the FIFA Football Language to provide a blueprint for how we analyse football. However, to date, each legacy football data collection business has its definitions and calculations, leading to inconsistent football data standards. Because of this, even the most basic comparisons between two different data sets can give different answers to the same question.

Noting how technology allows more and more data to be collected at potentially greater levels of speed and precision, it is fair to say that any grouping and definition of a dataset may not be universally consistent and continues to be a moving feast across the football data industry.

Why Develop Official Data Centralisation Strategies?

Servicing Stakeholders:

Although this article is only discussing on-pitch or sports data (and not fan data), the use cases we’ll discuss go beyond pure sports performance, as sports data equally plays an important role in the commercial performance of a league and its partners or stakeholders. By taking ownership of the sports data value chain, leagues can successfully create value for their entire ecosystem, which, next to its own, includes Clubs, Broadcasters and Commercial Partners.

The League, National Association or Federation will use Event Data feeds to fuel its owned and operated digital platforms’ match centres, video distribution, fantasy football and related fan engagement or gamification concepts to fans. In combination with Tracking Data, it will be an essential pillar in its content strategy and storytelling across its different platforms, catering to an increasing desire of fans to get official data insights in easily digestible formats. The same data is increasingly important in sports-related decision-making at the management level. The data is being used to support performance analysis, player pathways and competition benchmarking, as well as decision-making around sports regulatory frameworks or competition-related decisions, such as officiation analysis and changes to the competition formats. A centralised approach can strengthen the league's overall position within its ecosystem, as it can service its main stakeholders more effectively.

Where leagues can distribute or facilitate sports data distribution, they will create value for their member clubs. Data is one of those league projects that are to be centralised by the very nature of the topic. (Read how the Norwegian league implements a centralised ecosystem to better service its clubs). For clubs to individually broker data deals with data providers or collect data themselves can be considered suboptimal for various reasons. Firstly, the infrastructure and investment required to collect data is costly, and without the benefits of scale, this won’t make business sense. Equally, the data value is generally created by sharing and comparing data with peers, in this case, with the opponent teams. By centralising the data distribution through the league, individual clubs will benefit from the scale financially. Still, it will also allow them to get data feeds from away games and opponent teams. Like the league, Clubs will use the data for content and performance-related activities. Of course, the performance staff will be the main stakeholders in using data for scouting, performance and physical analysis. The clubs' performance staff will be putting the highest quality requirements for the tracking data to be correct, consistent and exhaustive.

Lastly, a league-centralised data model can be used to enhance the relationships with broadcasters, thus growing the overall quality and consistency of the media product and related revenues. By officialising a central data feed, the league ensures consistency across the different broadcasters of the competition. The broadcasters will use the data to fuel graphics engines and create storytelling during the game and for in-depth analyses pre- and post-game.

To summarise, sports data plays a key role within the business ecosystem of a league, creating commercial and performance value for the product, the competition, and its individual stakeholders. Where sports data is collected and used in a fragmented way, the benefits of its usage are below par. Within the league, there would only be a few clubs using data to improve performance or commercial revenue streams, this way the league wouldn't be in a position to offer partners and broadcasters official data feeds, resulting in different unofficial data sources being used across the league and different broadcasters. As a consequence, the end product will be negatively impacted.

To Productise and Commercialise:

Beyond servicing the official stakeholders in the ecosystem, leagues in control over their data streams can build data-related products to commercialise towards media outlets, broadcasters and publishers, as well as betting operators, potential sponsors and brands. This way, leagues can get their share of the value chain.

The challenge now is for sports organisations to build a business model around this centralised data opportunity and define how it will get there. This will be discussed in the next chapter, where relevant use cases will demonstrate possible different approaches.

Illustration of Player/Athlete Data

The Road Towards More Ownership: Phased Approach and Use Cases:

The sports industry is gradually moving towards a more centralised model of data ownership and distribution. Unlike in some sports, the highly fragmented nature of football means we have observed an elongated, phased approach, encompassing different stages of data and commercial influence.

We asked Andrew Cox, an authority across the sports data industry and advisor to LaSource, to help us explore each phase:

Phase 1: No ownership, client relationship

Phase 2: Servicing stakeholders by officialising data feeds

Phase 3: Scaling revenues and business operations via a partnership model

Phase 4: Insourcing collection, product and distribution

The Phases to claiming greater ownership of Data

“It would be fair to assume that all professional football federations, national associations and leagues now have an awareness that there is a direct commercial opportunity associated with data from their matches. Demand exists for match, team and performance data from internal and external stakeholders across every sector and use case imaginable,” states Andrew.

“The most astute also acknowledge that it is incumbent on them to take greater ownership of the strategic opportunity that this data can offer. But, despite this, the extent to which many leagues have been able to participate and benefit from the football data value chain has historically been through arm's-length rights payments in exchange for guaranteed match venue and video access.

“Most typically, this allows data to be “officially” collected and distributed to the sports betting industry, with leagues finding themselves working with data intermediaries on a transactional basis, as depicted in the diagram below.

“Over the passage of time, the balance of power and returns has started to transition to the leagues and federations. The extent to which this has become possible is largely a consequence of increasing competition amongst emergent data originators, distributors and service providers seeking the attention and affection of football rights holders in an emergent industry.

“This has led to various partnerships and alliances between data partners, providers and suppliers to football leagues. There is seemingly no one-size-fits-all approach or blueprint for success, even amongst leagues of similar stature. In a chaotic and rapidly evolving industry, a lack of requisite resources, domain knowledge or confidence in negotiating and developing data partnerships has proved to be a barrier to maximising data’s transformative impact for many leagues and their stakeholders.

“It is no surprise that LALIGA, DFL and the English Premier League - those with the greatest commercial leverage and capacity to invest - have developed the furthest. Their centralisation of official data strategy has taken different forms across data collection, storage, product and distribution. At the same time, the technologies, rights, legal and commercial frameworks that underpin and facilitate these arrangements are also very different.

“But what they have in common is that these football leagues have shown the most commitment to understanding and internalising some of the technologies and business drivers of the football data ecosystem and, as a direct result, are well-informed to negotiate the most beneficial partnerships for themselves.

Our Take On The Future:

In the evolving landscape of sports data, particularly within football, the trajectory towards centralised data ownership and distribution is evident through a phased approach outlined by Andrew.

Football leagues, in particular, have historically benefitted from a traditional business model of selling their media rights to the highest bidder. The value of these rights has witnessed systematic inflation over the years, with no substantial amount being added to complement its inflated value. This was evidenced by major European leagues such as the LFP and Serie A failing to meet the envisioned value of their media rights.

In an era where the incumbent model of the business model of leagues is being challenged by the evolution of time, technology and fan preferences, leagues must look towards innovating their business model to remain successful and, consequently, profitable.

A large part of this innovative approach would be claiming greater control of its data along the value chain. While not every league will go as far as directly investing in data collection, they will want to achieve greater transparency over the revenue streams generated, benefitting their commercial relationships and creating new revenue streams through a revenue-share model, for example.

The balance of power and returns has shifted, partly due to increased competition among data originators, distributors, and service providers. With substantial commercial leverage, leagues like LALIGA, DFL, and the English Premier League have advanced to the furthest extent in centralising their official data strategies. This involves diverse approaches across data collection, storage, product, and distribution, showcasing a commitment to understanding the intricacies of the football data ecosystem. As the industry continues to evolve, the future holds the potential for sports organisations to negotiate more beneficial partnerships, maximising the transformative impact of data for themselves.

“Whether its media rights, data, sponsorship or any other commercial value, at LaSource, we strongly believe in the ecosystem model, whereby rights owners and various stakeholders build mutually beneficial strategies to grow the overall value through deeper and more innovative partnerships. ”

How Do The Players Fit Into the Data Value Chain?

This article is part of our “Leagues-taking the Lead” series, focusing on the role of sports organisations in the ecosystem. However, when it comes to data, another important stakeholder is looking to take a stronger position within the Sports Data value chain: the Player.

For decades, players have been relatively unaware of the value of their IP. With David Beckham being the first to leverage the commercial value of his IP truly, players have been gradually taking more control over the commercial exploitation of their imagery. Now, as a second wave, we see an increasing interest of players and players’ representative bodies in understanding the value chain of the performance data linked to their activity on the pitch, to identify the role they could play in the sports data value chain as well as leveraging the power of this data in negotiating with clubs, like Kevin De Bruyne recently did with Manchester City.

To this very end, FIFPRO, the global union for professional footballers worldwide, has, together with LaSource, initiated the Player IQ Tech program to spread awareness to their member unions about the value of their data and how they can be more aware of how it is utilised and how they can take part in the growing value of data.

LaSource and Data Rights: What Do We Do?

LaSource is a consulting agency working with sports organisations and rights holders to build a data strategy that can help them unlock new revenue streams, increase performance, service multiple stakeholders, and achieve sustained growth. Explore our other services for sports organisations by clicking the link below.

If you would like to receive your curated guide of similar articles and new pieces around the themes of sports business, digital innovation, and new technologies, sign up to our newsletter here